Boulder’s economic growth is slowing, presenting many challenges for the city as it looks to revitalize its economy post-COVID. Boulder business leaders, city officials and local economists gathered in late January at the Boulder Chamber’s annual economic forecast event to discuss the economic trends impacting the nation, the state and the City of Boulder.

Slow growth has been a recurring theme since before the pandemic, with economists predicting a slowdown as early as 2019. That trend has now materialized and — amid inflation, post-pandemic strain and uncertainty over the new administration’s policies — Boulder businesses are feeling the impact.

“To say there's a lot of risks in the forecast right now would be sort of a super mild understatement,” said Richard Wobbekind, senior economist and faculty director at CU Boulder’s Leeds School of Business.

The great flattening

According to Brian Lewandowski, an economist at CU Boulder, the last 15 years “have been ours,” referring to the high gross domestic product (GDP), personal income and population growth Colorado has seen compared to other states. Today, however, Colorado is ranked 38th in real GDP growth, 33rd in personal income growth and 17th for population growth.

Boulder County echoes the slow growth trends seen in the state. The Boulder Metropolitan Statistical Area (MSA) has slipped in its ranking and now falls in the middle of the pack of the 400 MSAs across almost all metrics, ranking 128th in GDP growth, 374th in personal income growth and 231st in population growth.

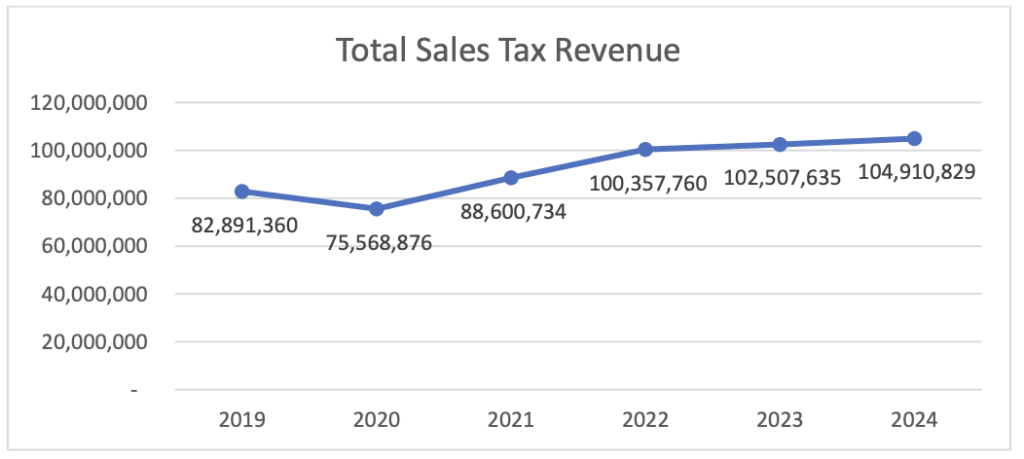

Sales tax collection data — often used as a proxy for retail activity — reveals flat year-over-year growth in Boulder. Statewide, the growth rate is only slightly better at 0.8%, which Lewandowski characterized as “absurdly slow.”

Experts say several factors are impeding Boulder’s economic progress: a tight labor market, high costs of living and the unpredictability of the new presidential administration.

Labor shortages, affordability and uncertainty

Colorado has a tight labor market, and data shows that Boulder has a distinct shortage of workers. The city's labor force participation has plateaued at peak levels for the past three years, while unemployment remains below historic norms. This sustained trend has led to an acute labor shortage.

These strains are worsened by an aging population, with “40,000 people retiring from our labor market every year,” according to Lewandowski. This creates what the presenters referred to as a supply-side issue, “slowing down job growth.”

Affordability is another constraint. Colorado’s high cost of living is evident in its housing market, with the state experiencing the highest year-over-year home price increase in the country at 6% — a rate that outpaces state inflation.

This issue is particularly pronounced in Boulder, where median housing prices exceed $1 million.

“We continue to see increases in [the number of] sales,” said Lewandowski, which some might argue means that Boulder is accessible. “But we also see an increase in median days on the market, so we’re not affordable.”

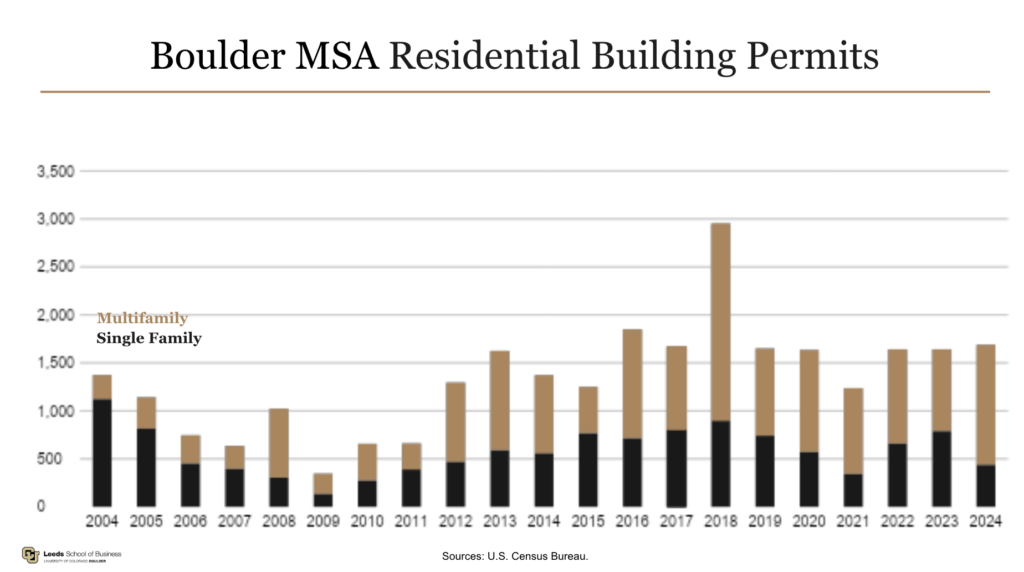

A contributor to high home prices is the slow recovery of the construction industry. High interest rates have contributed to a reduction in home building; in Boulder, data shows that building is flat, resulting in fewer new homes being added to the market.

The uncertainty of a new presidential administration also has business leaders worried, with concerns about immigration, healthcare policy changes and tariffs topping the list. Colorado has the most immigrants of a non-border state in the country. Shifting immigration policies could create labor force constraints.

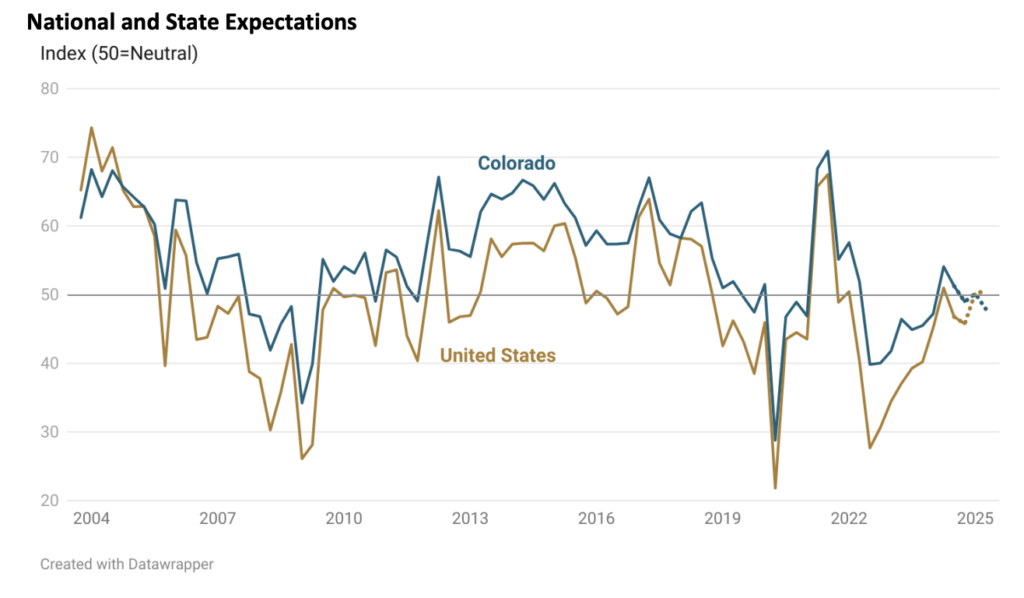

According to the most recent Leeds Business Confidence Index — a quarterly survey that gauges Colorado business leaders' opinions about economic trends and how their industry will perform in the coming quarter — business leaders’ expectations of local conditions lagged behind the nation in the current survey for the first time since 2005.

Said Wobbekind, “This is kind of unheard of.”

Hope in emerging industries

Although Boulder's previously rapid economic growth has decelerated, experts remain optimistic about the city's emerging industries, particularly quantum computing. Currently, the quantum sector supports approximately 3,000 jobs across Colorado, but with state funding approved by Gov. Jared Polis through House Bill 1325 in 2024, that figure could exceed 10,000 within the next decade, according to a CU Boulder Today article.

“We think some sectors will re-emerge from a business cycle that they've gone through,” Lewandowski explained. “In industries like construction, the mining industry, the energy sector and manufacturing, we think, will actually come out of its own recession in 2025, nationally and locally.”

In answer to Boulder’s economic challenges, Chamber President John Tayer said the organization has taken on some new responsibilities to “add a couple of extra tools to our quiver and respond to the economic needs of the time.”

The Chamber now houses the Transportation Connections Group to support the transportation needs of employees who can’t afford to live in the county. They’re also working on business recruitment to “help fill those vacant office buildings” created by the pandemic-era shift to remote work.

Tayer added that the Chamber has decided to host the Boulder County Film Commission with the intent of strengthening, “the burgeoning film and creative talent industry, whether or not we get the Sundance Film Festival.”

“The Boulder Chamber will need to respond in ways that best meet the challenges head on while taking advantage of the opportunities,” Tayer said at the event, “just as I know each of your own businesses will do kind.”